Average Collection Period Formula

10mm Cash Flows Per Year. The result of 40 indicates that the average accounts receivable collection period is 40 days.

Average Collection Period Definition Formula Guide Ratio Example

The different important points related to the Average Payment period are as.

. Average Collection Period. DSO is often determined. Browse cute pairs for tackling your period in style here at MS.

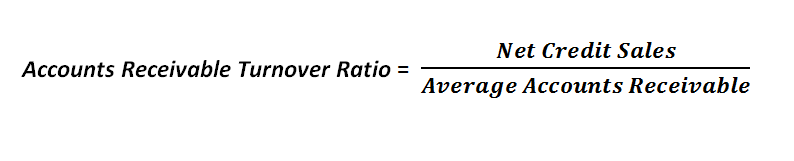

Accounts Receivable Turnover Ratio 100000 - 10000 In financial modeling the accounts receivable turnover ratio is used to make balance sheet forecasts. This means that the business owner can expect a credit sale to be paid by the customer within 40 days. It means on average the company takes 60 days to pay its creditors.

The numerator of the average collection period formula shown at the top of the page is 365 days. Lets talk about how a company calculates its average collection period. Discover comfortable cotton and luxurious lace at MS.

Days Sales Outstanding - DSO. Many companies and organizations use average to find out their average sales average product manufacturing average salary and wages paid to labor and employees. Generally the average collection period is calculated in days.

The average collection period formula is the number of days in a period divided by the receivables turnover ratio. Payback Period Example Calculation. 427 out of 5.

This can help them plan for how much cash they need to have on hand for expenses and bills. Breeze through your time of the month with our collection of period underwear. 4mm Our table lists each of the years in the rows and then has three columns.

Relevance and Uses of Average Formula. The average payment period of Metro trading company is 60 days. 317 out of 5.

The AR balance is based on the average number of days in which. Average Collection Period Formula. The formula for calculating how many times in that year Flo collected her average accounts receivables looks like this.

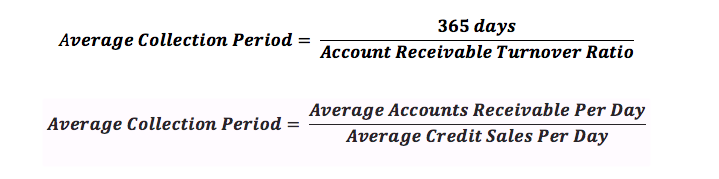

For many situations an annual review of the average collection period is considered. A shorter payment period indicates prompt payments to creditors. Alternative formula Average collection period Average accounts receivable per dayaverage credit sales per day read more and inventory processing period etc.

Average collection period 365Accounts Receivable turnover ratio. Average 12104 Average sales for months is 12104. The formula looks like the one below.

The company must calculate its average balance of accounts receivable for the year and divide it by total net sales for the year. 3pk Light Absorbency Period High Leg Knickers. First well calculate the metric under the non-discounted approach using the two assumptions below.

Days sales outstanding DSO is a measure of the average number of days that it takes a company to collect payment after a sale has been made. Buy 3 get 4th free. Average 60520 5.

However if the receivables turnover is. Average Collection Period Formula Average accounts receivable balance Average credit sales per day. In the first formula to calculate Average collection period we need the Average Receivable Turnover and we can assume the Days in a year as 365.

Like accounts payable turnover ratio average payment period also indicates the creditworthiness of the company. The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts receivable. Stock up your top drawer with playful and practical pieces from our collection of knickers.

Buy 3 get 4th free. The first formula is mostly used for the calculation by investors and other professionals.

Average Collection Period Meaning Formula How To Calculate

Average Collection Period Formula Calculator Excel Template

No comments for "Average Collection Period Formula"

Post a Comment